The Role of Financial Offshore Entities in Wealth Planning and Wealth Succession

The Role of Financial Offshore Entities in Wealth Planning and Wealth Succession

Blog Article

Why You Must Take Into Consideration Financial Offshore Options for Asset Security

In a period noted by economic fluctuations and growing litigation threats, individuals looking for durable asset defense might find solace in offshore financial choices (financial offshore). These choices not just supply enhanced privacy and potentially lower tax rates however likewise produce a tactical buffer versus residential economic instability. By discovering varied financial investment landscapes in politically and financially secure nations, one can attain an extra protected monetary footing. This technique triggers a reconsideration of possession administration methods, advising a better take a look at how offshore strategies may offer lasting financial goals.

Comprehending the Basics of Offshore Financial and Investing

While numerous people look for to enhance their economic protection and personal privacy, offshore financial and investing become viable approaches worth taking into consideration. Offshore financial refers to taking care of monetary assets in establishments located outside one's home nation, usually in territories understood for beneficial governing atmospheres. This can include reduced tax worries and enhanced personal privacy. Offshore investing in a similar way includes positioning funding right into investment possibilities across numerous global markets, which might offer greater returns and diversity benefits.

These financial approaches are especially eye-catching for those intending to protect possessions from economic instability in their home nation or to access to investment items not available locally. Offshore accounts could likewise provide stronger property protection versus legal judgments, potentially guarding riches extra efficiently. Nonetheless, it's important to understand that while offshore financial can offer considerable benefits, it also includes intricate considerations such as comprehending international financial systems and browsing currency exchange rate variants.

Lawful Considerations and Compliance in Offshore Financial Activities

Trick conformity concerns include adhering to the Foreign Account Tax Obligation Compliance Act (FATCA) in the USA, which needs reporting of international financial properties, and the Typical Reporting Requirement (CRS) set by the OECD, which entails info sharing in between countries to combat tax obligation evasion. Additionally, people must recognize anti-money laundering (AML) legislations and know-your-customer (KYC) regulations, which are rigorous in numerous territories to stop illegal tasks.

Understanding these lawful complexities is crucial for keeping the legitimacy and security of overseas financial involvements. Proper lawful guidance is vital to ensure full conformity and to optimize the advantages of overseas financial methods.

Contrasting Domestic and Offshore Financial Opportunities

Recognizing the legal intricacies of overseas monetary tasks helps financiers identify the distinctions between domestic and overseas monetary possibilities. Domestically, financiers are usually more accustomed to the regulative setting, which can provide a feeling of protection and ease of access. United state financial institutions and financial investment companies run under reputable legal frameworks, giving clear standards on taxation and investor protection.

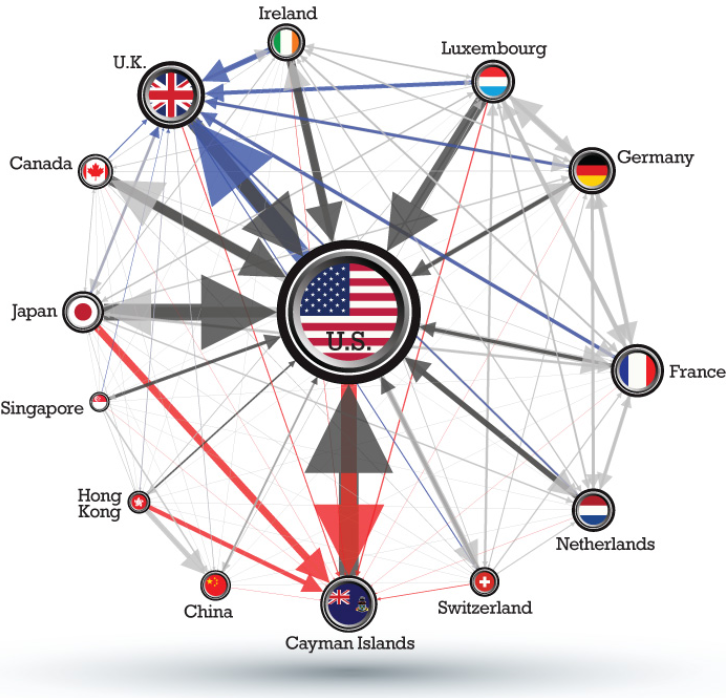

Offshore financial opportunities, however, usually use higher privacy and potentially lower tax prices, which can be useful for property security and growth. Jurisdictions like the Cayman Islands or Luxembourg are popular due to their favorable fiscal plans and discernment. These benefits come with challenges, consisting of boosted examination from international governing bodies and the intricacy of managing financial investments across different lawful systems.

Financiers must consider these aspects very carefully. The choice in between overseas and domestic try these out options must align with their economic objectives, risk resistance, and the legal landscape of the corresponding territories.

Steps to Start Your Offshore Financial Journey

Starting an offshore economic journey calls for cautious planning and adherence to legal standards. Individuals need to first carry out extensive study to determine ideal countries that supply robust economic services and positive legal frameworks for property protection. This includes reviewing the political you can look here stability, financial environment, and the certain laws connected to overseas financial activities in possible countries.

The next action is to seek advice from with a monetary expert or legal professional that specializes in worldwide money and taxation. These experts can give tailored recommendations, making certain compliance with both home country and global regulations, which is important for staying clear of lawful repercussions.

Once a suitable jurisdiction is picked, people should wage establishing the necessary financial structures. This generally consists of opening bank accounts and creating legal entities like counts on or companies, depending on the individual's particular monetary goals and demands. Each activity must be thoroughly documented to maintain transparency and facilitate recurring conformity with regulative demands.

Conclusion

In an age marked by economic changes and growing litigation risks, individuals seeking robust asset protection might locate relief in overseas monetary choices. financial offshore.Engaging in offshore financial activities requires a detailed understanding of lawful structures and regulative compliance across various territories.Comprehending the legal complexities of overseas monetary activities helps investors identify the distinctions between overseas and domestic financial possibilities.Offshore economic chances, however, usually provide greater try this out personal privacy and possibly lower tax obligation prices, which can be beneficial for asset defense and growth.Embarking on an offshore economic journey requires cautious preparation and adherence to legal guidelines

Report this page